IP insurers should pass on savings to consumers

THE five insurance companies providing integrated MediShield plans (IPs) for private health coverage need to explain to their 2.3 million policy holders why they will not be reducing their premiums with the launch of MediShield Life later this year.

The five insurers are NTUC Income, AIA, Great Eastern, Aviva and Prudential. They will, on average, save between 6 and 14 per cent in the amount of claims they need to pay out with the launch of MediShield Life, the new compulsory national medical insurance offered by the state.

This is because MediShield will pick up a larger share of the claims. The decrease is an estimate from the Life Insurance Association Singapore (LIA).

IP insurance has two tiers: The first is the basic health insurance tier common to all residents. This portion has premiums set by the Government, and payouts come from MediShield.

The second tier is the private tier, and premiums and payouts vary according to insurer and the choice of plan.

With the introduction of a more generous MediShield Life tier from end-2015 that takes up a larger share of the payouts, insurers are expected to pay less in claims.

Some of these savings should be passed on to policy-holders, not merely fatten the coffers of the insurance companies. They should go towards offsetting at least part of the higher premiums MediShield Life will levy.

Instead, the five companies offering a total of 21 IPs announced that they will not raise their portion of the premium for at least a year.

That is not good enough.

Policy-holders, as well as the Government, which runs the basic scheme, should demand an explanation of why none of the savings the insurers will enjoy will be passed on to policy-holders.

After all, the other parties are all paying more. People are paying more in premiums for MediShield Life. The government has committed $4 billion in subsidies - both permanent and transitional - to offset the higher premiums under MediShield Life.

This subsidy from the Government - covering at least 90 per cent of the premium increase in the first year - is to benefit people, not to add to insurers' profits. Insurance companies, which will save in claims payouts, should therefore reduce their premiums.

In fact, it is not just current premiums that are of concern.

More worrying is the trend of rising claims, which will have a knock-on effect on premiums.

The LIA disclosed that the claims payout from the five insurers has been rising 12 per cent a year for the past few years for public hospital A and B1 class bills.

For private hospital bills, the increase is 17 per cent. This is an average as the actual increase varies with policies and insurer.

This is way above the national healthcare inflation rate, which averaged 3.7 per cent over the past three years.

In fact, it would appear that the IPs are driving healthcare inflation with the large claims paid out - something the high-level MediShield Life Review Committee was concerned about and suggested "cost management efforts and collaboration among insurers" to keep a lid on payouts.

LIA said that given the huge annual increase in payouts, the five insurers will not be able to hold premiums down for long beyond the promised one year.

The trend of rising claims and rising premiums is not something to be accepted, but something to be arrested.

Otherwise, if premiums rise 12-17 per cent a year in tandem with claims payouts, they could triple in a decade.

Insurers should be required to give an indication of what their premiums would be like in 10 years' time - and should be held to those rates, allowing for a small upward rise to take inflation into account.

People can then pick the plan they want, based not on what they can afford to pay in premiums today, but whether they can still afford the premiums as they age.

Unless a lid is put on the huge increases in payouts - by no stretch of imagination can an annual increase of 12-17 per cent be considered "normal" - Singapore can expect to see healthcare inflation spiral out of control.

If the situation remains unchecked, the future could see soaring demand for subsidised care, especially given Singapore's rapidly ageing population.

Background story

Insurers should be required to give an indication of what their premiums would be like in 10 years' time...

People can then pick the plan they want, based not on what they can afford to pay in premiums today, but whether they can still afford the premiums as they age.

The Straits Times / Opinion Published on Tuesday, 30 June 2015

By Salma Khalik, Senior Health Correspondent

IP insurers should pass on savings to consumers

Please click the following for other Related Readings:

Alexandra Hospital closes for renovation; Ng Teng Fong General Hospital officially opens today

CapitaLand fulfils conditions to acquire Danga Bay land

Ten industrial sites confirmed for tender

DBSS flat owners at Trivelis may get goodwill package following slew of complaints

Residents of DBSS project Pasir Ris One complain over flaws, lack of corridor space

Pasir Ris One residents complain: Other DBSS projects that made headlines

Comparing corridors across different public housing projects

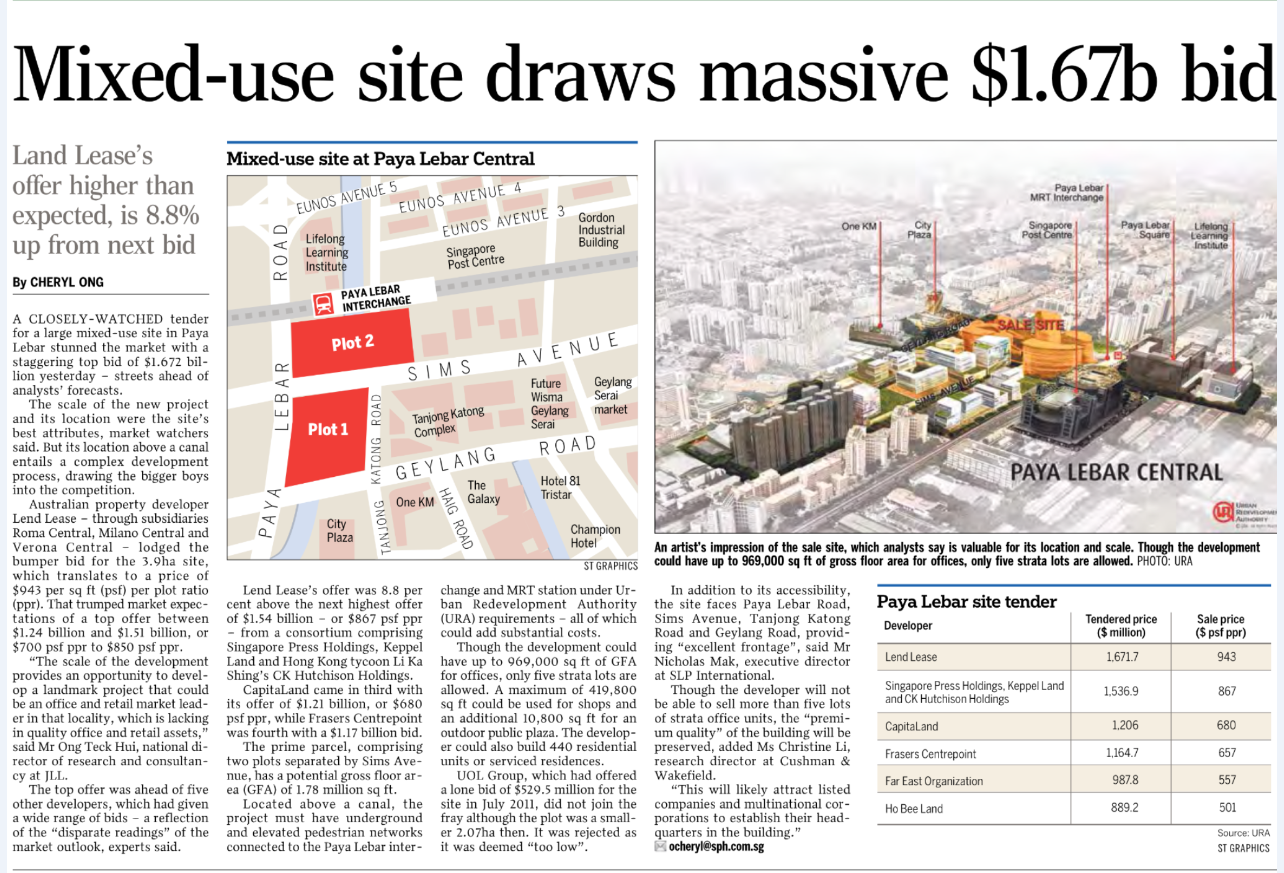

Sales of 2 condos at Sentosa Cove raise hopes of rebound

Corridors of discontent at Pasir Ris One

Freehold redevelopment site in Katong up for tender

33 Parklane basement units for sale

Warehouse market faces challenges in short term: Reit boss

Slower sales, fewer visitors hit Q2 shop rents

$483m top bid for private home site in Queenstown

More details of new HDB scheme revealed

Pasir Panjang Terminal's $3.5b expansion kicks off

Eye on Lavender: Transformation in progress

Centrale 8 in spotlight over defects

Private home prices 'could fall another 10% in next 2 years'

Buy resale flat near parents? Financial help is key: Experts

Dawson's SkyVille and SkyTerrace projects are raising the bar for stylish public housing

In pictures: Stylish BTO projects at Dawson's SkyTerrace and SkyVille

24% apply for BTO flats under schemes to help families live closer together: Minister Khaw Boon Wan

Singapore surprised by Malaysian transport agency stating preference to end high-speed rail in Johor

Malaysia's transport agency says CEO misquoted on high-speed rail

Sungei Pandan waterfront site may yield 600 homes

Toa Payoh private residential site draws 14 bids

Protecting property agents and consumers

Frasers Hospitality buys boutique hotel group in Britain

Alexandra Hospital closes for renovation; Ng Teng Fong General Hospital officially opens today

CapitaLand fulfils conditions to acquire Danga Bay land

Ten industrial sites confirmed for tender

DBSS flat owners at Trivelis may get goodwill package following slew of complaints

Residents of DBSS project Pasir Ris One complain over flaws, lack of corridor space

Pasir Ris One residents complain: Other DBSS projects that made headlines

Comparing corridors across different public housing projects

Freehold redevelopment site in Katong up for tender

33 Parklane basement units for sale

Slower sales, fewer visitors hit Q2 shop rents

$483m top bid for private home site in Queenstown

More details of new HDB scheme revealed

Pasir Panjang Terminal's $3.5b expansion kicks off

Eye on Lavender: Transformation in progress

Centrale 8 in spotlight over defects

Private home prices 'could fall another 10% in next 2 years'

Buy resale flat near parents? Financial help is key: Experts

Dawson's SkyVille and SkyTerrace projects are raising the bar for stylish public housing

In pictures: Stylish BTO projects at Dawson's SkyTerrace and SkyVille

24% apply for BTO flats under schemes to help families live closer together: Minister Khaw Boon Wan

Singapore surprised by Malaysian transport agency stating preference to end high-speed rail in Johor

Sungei Pandan waterfront site may yield 600 homes

Toa Payoh private residential site draws 14 bids

Protecting property agents and consumers

No comments:

Post a Comment